Contents:

The 4 Price Doji is simply a horizontal line with no vertical line above or below the horizontal. This Doji pattern signifies the ultimate in indecision since the high, low, open and close by the candle are the same. The 4 Price Doji is a unique pattern signifying once again indecision or an extremely quiet market.

For this reason, traders will often combine it with other technical indicators before making trade decisions. The Shooting Star is a bearish reversal pattern that forms after an advance and in the star position, hence its name. A Shooting Star can mark a potential trend reversal or resistance level. The candlestick forms when prices gap higher on the open, advance during the session, and close well off their highs. The resulting candlestick has a long upper shadow and small black or white body.

Is a Doji pattern bullish or bearish?

Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. Therefore, it is crucial to conduct thorough analysis before exiting a position. This article explains what the Doji candlestick is and introduces the five different types of Doji used in forex trading.

Other indicators should be used in conjunction with the Dragonfly Doji pattern to determine potential buy signals. Successful traders will typically wait until the following day to verify the possibility of an uptrend after a Dragonfly. Investors are requested to note that Stock broker is permitted to receive/pay money from/to investor through designated bank accounts only named as client bank accounts. Stock broker is also required to disclose these client bank accounts to Stock Exchange. Hence, you are requested to use following client bank accounts only for the purpose of dealings in your trading account with us. The details of these client bank accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker”.

When it forms at the bottom of a downtrend, the dragonfly doji is considered a reliable indication of a trend reversal. This is because the price hit a support level during the trading day, hinting that sellers no longer outnumber buyers in the market. If the security is considered to be oversold, which may require the assistance of additional technical indicators, a bull movement may follow in the days ahead.

However, at the end of that https://g-markets.net/, the close price is still able to stay at the level of the open price. It suggests that buyers in the market are able to absorb this much selling and pull back the price. A dragonfly doji is considered a signal of a potential reversal in the security price. It occurs when the open, close, and high prices of a security are virtually the same. Thus, a dragonfly doji is T-shaped without an upper tail, but only a long lower tail.

This is important for a strategy to work in live trading, since we otherwise run a high risk of curve fitting, meaning that the strategy doesn’t work on live data. In the strategy examples below, we’ll use the ADX indicator, which is one of our favorite trading indicators, to measure the trend strength. All these conditions could work quite differently, even when tested on the same market. However, we have trading strategies that make use of all three versions, and recommend that you test all of them to see what works best. The market is in a bearish trend, and the dominant market sentiment is bearish.

Analyzing Doji Candles with TradingView and Special Offer

It looks like an upside-down version of the Dragonfly and it can signal a possible downtrend. In other words, when the Doji candle pattern appears, it shows the balance between supply and demand of the market. After the Doji is broken, the market may reverse or resume the previous trend. True Gravestones are rare since open, high, and closing prices are seldom the same. In this case, it also helps to place a stop-loss for a sell order lower than the low data point of the downtrend.

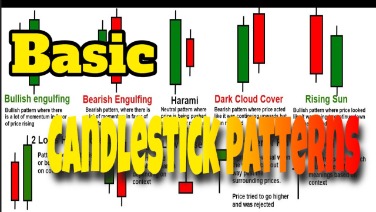

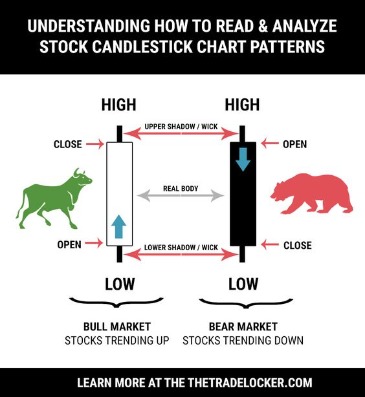

It looks like an upside-down version of the Gravestone and it can signal a coming uptrend. The construction of the Gravestone Doji pattern occurs when bulls press prices upward. Candlestick patterns seldom work very well on their own, and most traders would agree that you need to include some type of filter or extra condition to make them tradable. Candlesticks do not reflect the sequence of events between the open and close, only the relationship between the open and the close. The high and the low are obvious and indisputable, but candlesticks cannot tell us which came first. Long black candlesticks indicate that the Bears controlled the ball for most of the game.

This indicates increased dragonfly doji meaning pressure during a downtrend and could signal a price move higher. Following a downtrend, the dragonfly candlestick may signal a price rise is forthcoming. Following an uptrend, it shows more selling is entering the market and a price decline could follow. In both cases, the candle following the dragonfly doji needs to confirm the direction. While the Gravestone Doji and Dragonfly Doji have opposing meanings and are employed in different contexts, their shapes and attributes are similar.

How reliable is the dragonfly doji?

After an upward trend, a dragonfly doji indicates a potential price drop, which can be confirmed if the following candlestick moves down. The dragonfly doji is used to identify possible reversals and occurs when the open and closing print of a stock’s day range is nearly identical. Dragonfly dojis are very rare, because it is uncommon for the open, high, and close all to be exactly the same. The example below shows a dragonfly doji that occurred during a sideways correction within a longer-term uptrend. The dragonfly doji moves below the recent lows but then is quickly swept higher by the buyers.

How to Trade the Doji Candlestick Pattern – DailyFX

How to Trade the Doji Candlestick Pattern.

Posted: Fri, 07 Jun 2019 07:00:00 GMT [source]

A Doji candle pattern is generally seen as a sign of indecision in the market, as there is no clear direction being taken by buyers or sellers. The best way to trade these Doji patterns is to look for them at the end of a pullback in a trend. In an up-trending market, look for the Dragonfly Doji, Morning Doji Star, Harami Cross, or Inside Bar when the price pulls back to a support level. Here, those patterns are more likely to be the beginning of a new upswing, so you are looking to go long.

Long white candlesticks indicate that the Bulls controlled the ball for most of the game. Hello Rayner, since I knew a while ago the real meaning of the Doji has been trading with very good results, especially in trend markets. His super excellent explanation and clarifies more the concept he had.

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

Filled candlesticks, where the close is less than the open, indicate selling pressure. In order to create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display. The hollow or filled portion of the candlestick is called “the body” (also referred to as “the real body”). The long thin lines above and below the body represent the high/low range and are called “shadows” (also referred to as “wicks” and “tails”).

Depending on where it forms, it could indicate a change in the price direction or a continuation in the present direction. When it occurs within a price swing, price continuation is more likely. The Doji candlestick pattern is characterized by its cross, inverted cross, or plus sign shape, which reflects that the open and close prices are the same. It has very little or no real body, while the upper and lower shadows may be of varying sizes. Alone, the Doji candlestick is a neutral pattern but may also feature in a number of important patterns.

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

Neither buyers nor sellers could gain the upper hand and the result was a standoff. After a long advance or long white candlestick, a spinning top indicates weakness among the bulls and a potential change or interruption in trend. After a long decline or long black candlestick, a spinning top indicates weakness among the bears and a potential change or interruption in trend.

How to trade using the doji candlestick pattern – ig.com

How to trade using the doji candlestick pattern.

Posted: Fri, 04 Sep 2020 12:03:59 GMT [source]

Successful traders will typically wait until the following day to verify the possibility of a downtrend after a Gravestone. When the price hits the bottom part of the downtrend, then you can expect that the market may bring a reversal. It may actually imply indecision in the market where neither the bulls nor the bears have any clue about the direction the market or the stock is going to go. As such, when the market is above the upper Bollinger band, we’re at overbought levels, indicating an imminent market reversal (in the case of mean-reverting markets). Commodity and historical index data provided by Pinnacle Data Corporation. The information provided by StockCharts.com, Inc. is not investment advice.

However, the morning rally did not last long before the bears took over. From mid-morning until late-afternoon, General Electric sold off, but by the end of the day, bulls pushed GE back to the opening price of the day. The first doji outlined on Chart 1 in the previous section was a high-low doji, where prices made the highs for the day first, and the lows for the day second.

A dragonfly doji candlestick is a candlestick pattern with the open, close, and high prices of an asset at the same level. It is used as a technical indicator that signals a potential reversal of the asset’s price. In financial charts, the Gravestone Doji trend is a bearish reversal trend.